Get Answers on Montana Motorcycle Bill of Sale

-

What is a Montana Motorcycle Bill of Sale?

A Montana Motorcycle Bill of Sale is a legal document that records the transfer of ownership of a motorcycle from one party to another. It serves as proof of the transaction and includes essential details about the motorcycle, the buyer, and the seller.

-

Why do I need a Bill of Sale for a motorcycle in Montana?

Having a Bill of Sale is crucial for several reasons. It protects both the buyer and the seller by providing a written record of the sale. This document can be useful for registering the motorcycle, obtaining insurance, and proving ownership in case of disputes. Additionally, it may be required by the Montana Department of Justice when transferring the title.

-

What information is included in the Bill of Sale?

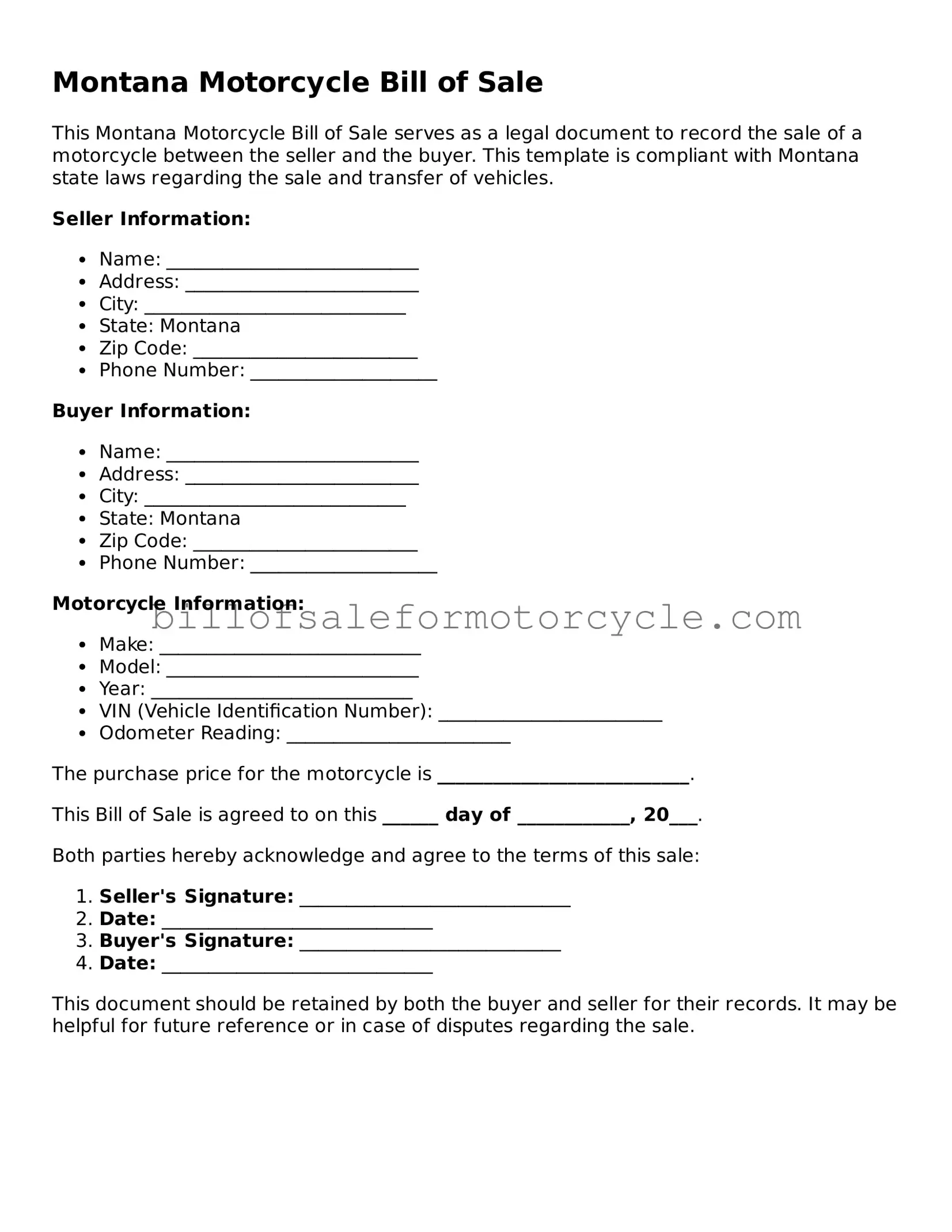

The Bill of Sale typically includes:

- The names and addresses of the buyer and seller

- The motorcycle's make, model, year, and Vehicle Identification Number (VIN)

- The sale price

- The date of the transaction

- Signatures of both parties

-

Do I need to have the Bill of Sale notarized?

In Montana, notarization is not required for a Bill of Sale. However, having it notarized can add an extra layer of protection and authenticity, especially if you plan to use it for legal or registration purposes.

-

Can I use a generic Bill of Sale template?

While you can use a generic Bill of Sale template, it’s best to ensure it meets Montana's specific requirements. Customizing the template to include all necessary details about the motorcycle and the transaction is advisable to avoid any issues down the line.

-

Is a Bill of Sale the same as a title?

No, a Bill of Sale is not the same as a title. The title is an official document that proves ownership of the motorcycle. The Bill of Sale is simply a record of the transaction. When you purchase a motorcycle, you will need both documents for a complete transfer of ownership.

-

What if I lose the Bill of Sale?

If you lose the Bill of Sale, it can be challenging to prove the transaction took place. It’s a good practice to keep multiple copies in a safe place. If necessary, you can create a new Bill of Sale with the same details and have both parties sign it again to ensure clarity.

-

How does the Bill of Sale affect taxes?

The Bill of Sale can impact taxes, particularly sales tax. When you purchase a motorcycle, you may be required to pay sales tax based on the sale price listed in the Bill of Sale. It's essential to keep this document for your records when filing taxes.

-

Where can I obtain a Montana Motorcycle Bill of Sale form?

You can find Montana Motorcycle Bill of Sale forms online, often available for free. Many websites provide templates that you can fill out. Additionally, you can create your own Bill of Sale using the necessary information outlined earlier.